when will the housing market slow down uk

If deals are being struck by older people you dont. What can we expect from the property market in 2022.

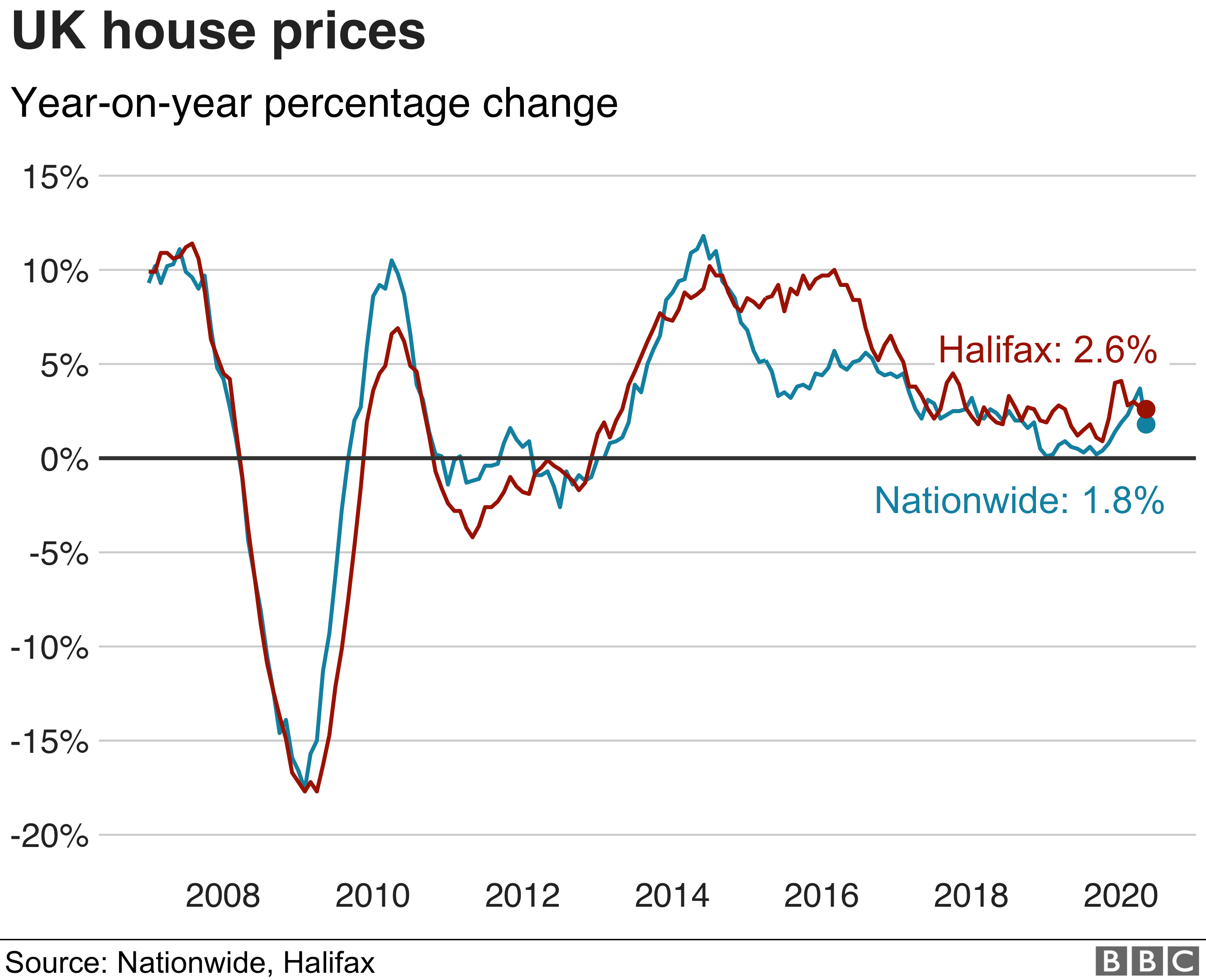

Coronavirus May Have Huge Impact On Property Markets Bbc News

PA Property experts have called the.

. As supply and demand begin to level out we can expect a gradual return to normal for the housing market. Seen in the City Londons Travel Lifestyle Magazine. The runaway house price growth of the past two years is set to slow as the wider economy braces for.

However there will be a shake-up in. Experts predict that house price growth will slow down as the year progresses. Savills forecasts overall price rises of 35 this year and 3 in 2023.

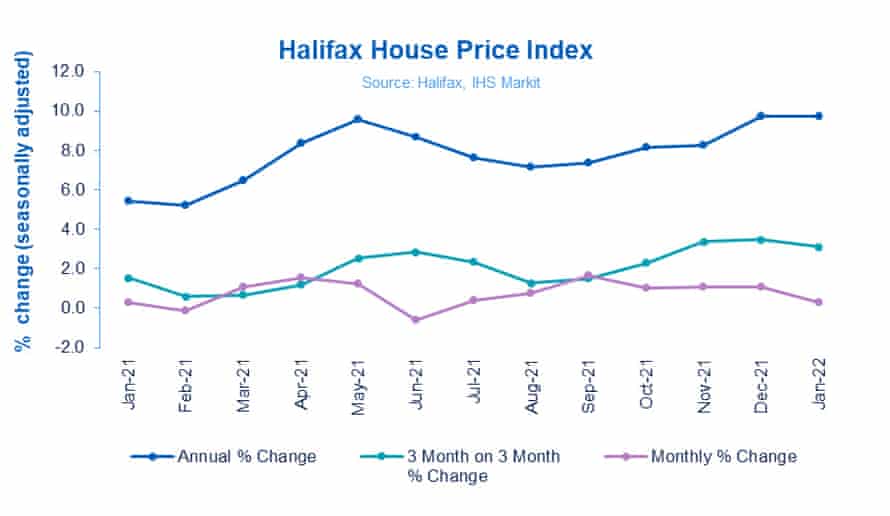

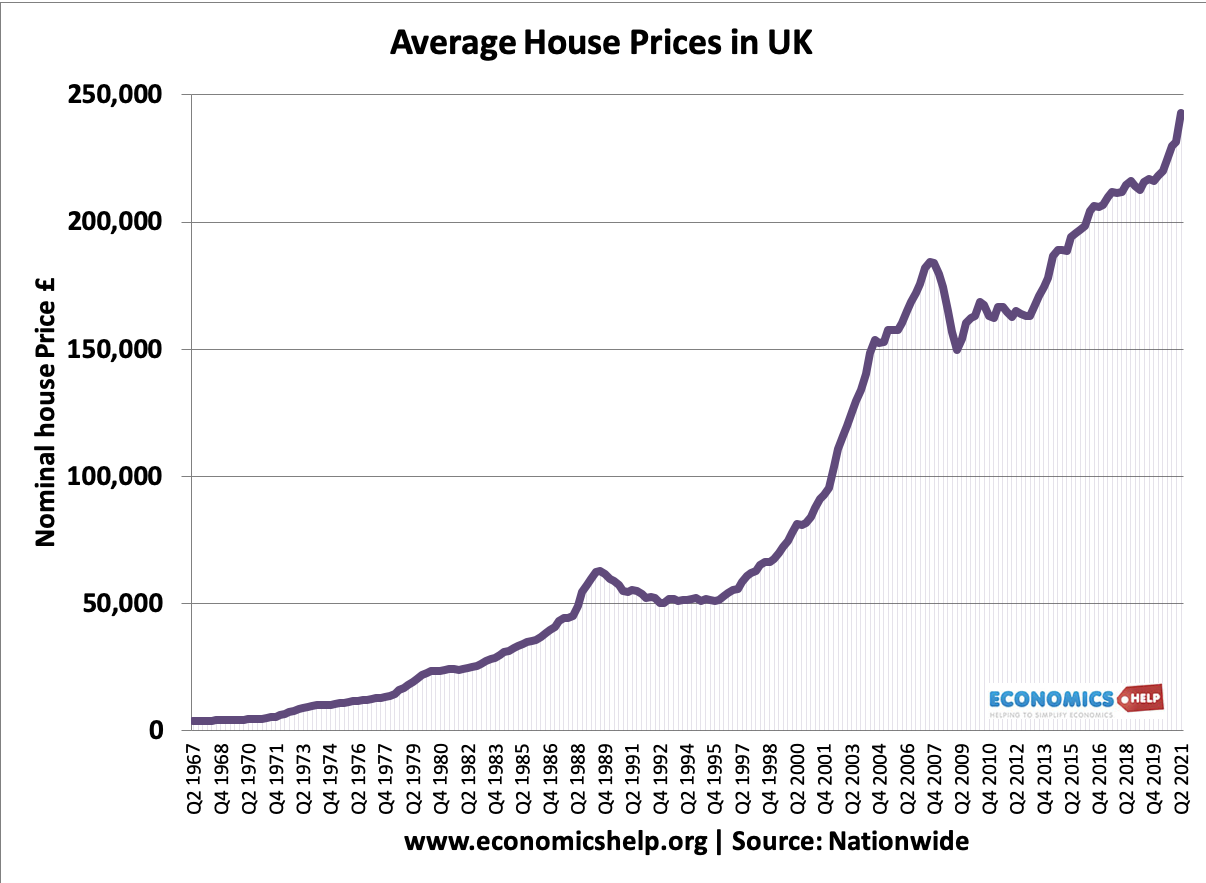

Britains housing market is to slow dramatically in 2022 as borrowing costs rise and household budgets come under mounting strain property experts have predicted. This is partly due to the stamp duty holiday which was in full swing at the turn of 2021 and driving a booming trade in the property market. Nationwides figures for April 2022 put the average house price at 267620 up from 265312 in March.

The property portal Zoopla has similar projections forecasting a 3 rise this year. Property transactions were down 222 per cent in January compared to December as experts suggest the market is beginning to slow down. This rapid house price that is still in progress is being driven by stock shortages and post-pandemic lifestyle changes but is obviously not sustainable over the longer term.

The average house price has increased nearly 30000 in the past year but recent stats reveal the UK housing market might be slowing down. As the UK emerges from the impact of the pandemic housing transactions are expected to decline by 20 from their high of 15m in 2021 to 12m in 2022 in line with the long-run average but still relatively high compared to the last decade. Halifax expects strong housing price levels to be maintained the average UK house price is 272992 almost 34000 higher than at the start of the pandemic but that growth in 2022 would.

As Nationwide the UKs second-biggest mortgage lender predicted a housing market slowdown on Friday its chief executive lamented the injustice of the cost of living crisis piling more pain on the worst-off. The dynamics of the housing market are shifting in many ways with rising mortgage rates becoming a factor for the first time in a while. As he noted rising cost of living and increased interest rates may change the landscape for some buyers but the market is likely to stay strong through 2022 but perhaps less dramatic than we saw in 2021.

All London Restaurants London First Look London Top Lists. The housing market is being sustained by these equity-rich homeowners. This marks a year on year increase of.

The UK property market boom might soon be over as experts predict that rising inflation and the cost of living crisis could cause prices to. London Top Lists. Miles according to fire officialsOfficials told residents of four counties Mora San Miguel Taos and Colfax to remain on high alert for changes to evacuation statuses.

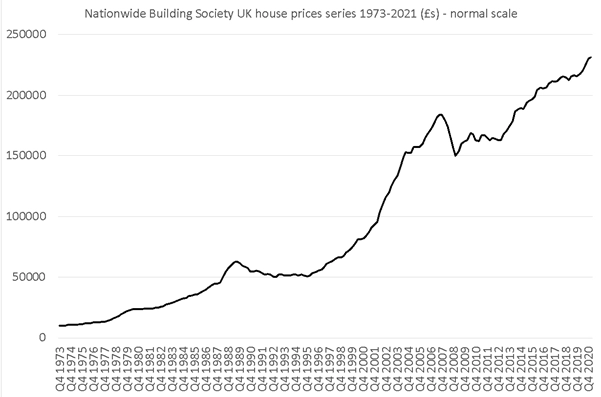

Initially there was a slump as the country entered into lockdown for the first time in March 2020 before a massive resurgence from June 2020 when society began opening up again. Overall prices are up 24500 compared with this time last year and 37500 higher than two years ago. The property market has boomed over the past decade with the price of an average UK home reaching a record 286079 last month up by 11 from March.

Indeed HMRC revealed the number homes sold in January may have been higher than in December 51 but it was 106 fewer than in January 2021. Slowdown ahead for UK housing market. Of course the housing market is exposed the housing market is always exposed.

And despite fears of a pandemic-induced. The fire took everythingThe Calf Canyon-Hermits Peak fire was continuing to spread on Friday May 20 having burned over a total of 303701 acres 475 sq. Once the wave of lockdown-savers purchasing property has come to a slow-down we can inevitably expect house price inflation to slow down too.

As housing costs continue to consume a greater portion of home purchasers paychecks buyers will become more inventive. The monthly mortgage payment on the median-asking-price home which has risen to 408458 has hit a record high of 2404 at the current 527 mortgage rate per Redfin. Saturday May 21 2022.

The big picture. Seen in the City Londons Travel Lifestyle Magazine. The housing market has been tumultuous over the past 2 years with the pandemic having a direct impact on house prices.

Mike Scott chief analyst at online agency Yopa says. View All Result.

The Square Mile London S Financial District Bank Of England Fintech England

The Housing Market Faces Its Biggest Test Yet Fortune

Uk House Prices Hit Record High But Slowdown Looms Eurozone Bond Yields Rise As It Happened Business The Guardian

House Prices Defy Slowdown Predictions To Rise At Fastest For 17 Years Evening Standard

Home Prices To Drop By Late 2022 Says The Mortgage Brokers Association Fortune

House Prices Should We Welcome A Crash Uk In A Changing Europe

Why Are Uk House Prices So High Economics Help

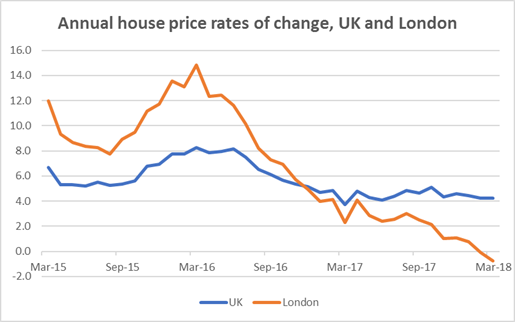

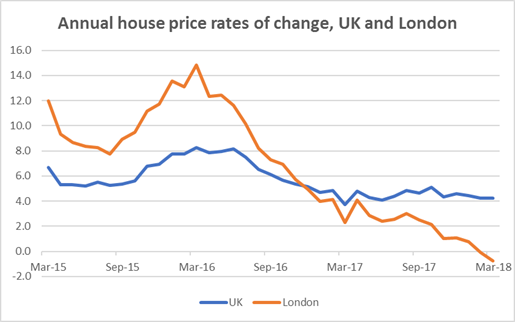

Why Are London House Prices Falling National Statistical

House Prices Should We Welcome A Crash Uk In A Changing Europe

How Long Can The Global Housing Boom Last The Economist

U K House Prices Surge Again With Lack Of Supply Rics Says House Prices First Time Home Buyers Home Buying

How Long Can The Global Housing Boom Last The Economist

The Housing Market Faces Its Biggest Test Yet Fortune

When Will House Prices Fall Times Money Mentor

If The U S Housing Market Gets Hot Like The Canadian Housing Market

Will U K House And Property Prices Rise In 2022 Mortgage Lenders See Slowdown Bloomberg

Shrinking Like A Tire With A Slow Puncture Uk House Price Growth Is Slowing Down House Prices Architecture House House Styles

Housing Market Braced For Slowdown After 17 Year High The Independent